Blue Finance Blended Vehicle

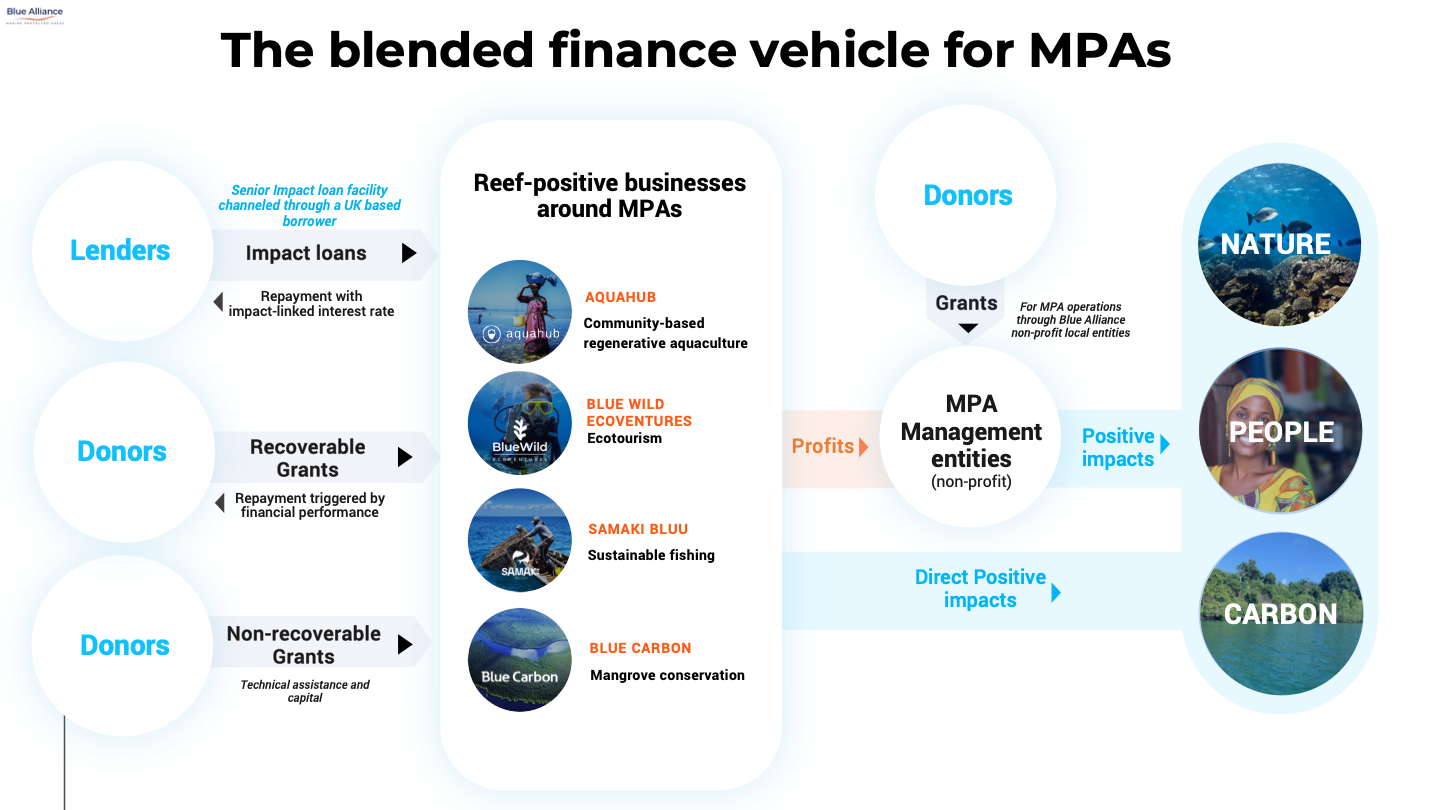

The Blue Alliance blended finance vehicle is an innovative model closing the funding gap for large Marine Protected Areas (MPAs) across the Philippines, Tanzania, and Indonesia. By combining grants, concessional debt, and recoverable grants, the mechanism is structured to unlock US$20 million in private impact investment for reef-positive businesses that directly support MPA co-management. The model supports MPAs covering 1.7 million hectares—with plans to expand to 3 million hectares by 2030—by incubating enterprises in ecotourism, aquaculture, and sustainable fisheries, which generate dividends to finance long-term conservation.

Catalytic funding from the Global Fund for Coral Reefs (GFCR) has been essential in designing the facility and supporting early-stage operations. GFCR’s US$5.2 million grant financed legal structuring, business planning for three MPAs and seven enterprises, and MPA management activities. Impact loans from partners like BNP Paribas are linked to environmental and social performance, offering lower interest rates for higher ecological outcomes. Each business operates under co-management agreements with local authorities, ensuring continuity, community benefit, and investor protection. The aggregation of reef-positive businesses into one investment portfolio allows economies of scale, reduces investor risk, and enhances efficiency. A parametric insurance product further protects against climate-related business interruption. With an ambitious target to scale this model to 70 million hectares globally by 2040, the Blue Alliance finance vehicle is poised to become a cornerstone of sustainable ocean finance and coral reef protection worldwide.

The below diagram illustrates the structure of this finance solution: